Flovi-drivers Expenses and travel allowances

Travel and Expense Reimbursements for Flovi Assignments

Travel and expense reimbursements related to Flovi assignments are processed according to Flovi’s compensation periods.

We recommend that you submit your travel and expense claims immediately after completing your gig, but no later than by 3 PM on the Monday following the previous payment week.

If the compensation period has already ended and you still have expenses or mileage from that period, you can include them in your personal tax return. Please also make sure that the expenses of your gigs do not exceed the amount of your salary during your commission period.

Travel allowances

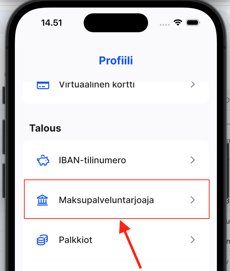

Travel reimbursements are submitted via the Flovi app "Maksupalveluntarjoaja" and then by pressing the button “Claim your expenses” (for a moment "vieraile" or "visit")

See the image on the left. Please make sure you have the app updated to the latest version. You can do this from either the Play store or the App store.

To be able to log your expenses via a browser on your computer, Click the send button and you will receive a link in your email, which you can use to log in via a browser on your computer in the future. If you do not receive the message, please also check your spam and any marketing folders where the message may have gone. Please note that the link is personal

To be able to log your expenses via a browser on your computer, Click the send button and you will receive a link in your email, which you can use to log in via a browser on your computer in the future. If you do not receive the message, please also check your spam and any marketing folders where the message may have gone. Please note that the link is personal

NOTE! You can ONLY claim mileage reimbursement for the use of your own vehicle when you are the driver or a passenger in the vehicle.

Click the button to start entering your expenses “Create new”.

1. If you want to log mileage, start here and press “Add new route”:

-

-

-

Fill in the required details

- In the address information, enter only the name and number of the road or street, not the apartment number and letter. For example, Highway 6 (not Highway 6 b 12)

-

and press “Calculate route and distance”

-

You can add multiple routes if needed

-

-

- There is a small adjustment symbol when selecting transport. When you click on it, a new box will open below, where you can change the mileage amount downwards. If you change your mind and do not want to change the amount, click on the small arrow inside the box and the optional amount box will be removed from your application.

2. If you want to log daily allowances, continue to section 2 and press “Add daily allowance”

-

Fill in the required details

- You will also see the status of your expenses when you are creating an application and an adjustment symbol next to the number of days of daily allowance. By clicking on the symbol, a new box will open where you can adjust the number of days of daily allowance and price downwards.

- If you change your mind and do not want to change the daily allowance amount, click on the small arrow inside the box and the optional amount box will be removed from your application.

- When choosing a date, you can click on the calendar symbol to select a day and time from the menu, or type the desired day and time into the box.

E.g. 17.8.2025 14.00

For daily allowances, here's a quick guide:

- To qualify for half-day allowance, the work-related travel must last more than 6 hours

-

To qualify for full-day allowance, the travel must last more than 10 hours

You cannot apply for a daily allowance

if you stay over night at home, in which case the gig will end at the time you arrive home from the gig.

if you stay in another location after the gig, and the new gig does not start the next morning.

When you are looking gig´s, is not considered working time and you cannot apply for daily allowance for this time.

Expense Reimbursements

1. Expense reimbursements are submitted via the Flovi app "Maksupalveluntarjoaja" and then by pressing the button “Claim your expenses” (for a moment "vieraile" or "visit")

See the image on the left. Please make sure you have the app updated to the latest version. You can do this from either the Play store or the App store.

To be able to log your expenses via a browser on your computer, Click the send button and you will receive a link in your email, which you can use to log in via a browser on your computer in the future. If you do not receive the message, please also check your spam and any marketing folders where the message may have gone. Please note that the link is personal.

To be able to log your expenses via a browser on your computer, Click the send button and you will receive a link in your email, which you can use to log in via a browser on your computer in the future. If you do not receive the message, please also check your spam and any marketing folders where the message may have gone. Please note that the link is personal.

Click the button to start entering your expenses “Create new”.

3. If you want to log receipts, start from section 3 and press “Add expense receipt”

-

Click “Take a photo” or “Select file”

-

Wait for the AI to analyze the receipt and auto-fill the info boxes

-

Correct or fill in any missing information

-

Add multiple expenses if needed

Make sure your receipt shows:

-

The total amount

-

The VAT

-

The payment method

-

The merchant’s details

If this information is missing, your expense may be rejected.

Examples of Biila Go gig travel allowances and expenses

- You drive a gig from Vaasa to Pori. You start driving at 10:15 and arrive in Pori at 12:45. You cannot claim a partial daily allowance because your working time is less than 6 hours.

- You travel from your home in Vaasa to Pori by bus on Wednesday. You stay at your friend's place and get a gig to Vaasa the next day. The drive starts at 13:15 and ends at 15:50. You cannot claim a daily allowance because your working time is less than 6 hours. You can include the bus ticket in your expense claims.

- You drive a gig from Vaasa to Pori in the evening. You started driving at 19:00. You stay at your friend's place. The next day, you drive a trip from Pori to Vaasa and arrive at 11:00. You can claim a full daily allowance because the work continues the next morning. So, the workday lasts over 10 hours.

- You do a gig for Flo in the morning that lasts over 6 hours and then immediately move on to another client's gig that lasts several hours. In total, the gig for two different clients lasts over 10 hours.